In a world where the only constant is change, leadership has evolved into a dynamic art form—one that requires agility, foresight, and an unwavering commitment to growth. Gone are the days when leaders could rely on established norms and fixed strategies to guide their teams through challenges. Today’s fast-paced business landscape demands innovative thinkers who can pivot at lightning speed, embrace disruption with open arms, and inspire others to thrive amidst uncertainty. Whether you’re steering a startup or managing a corporate giant, understanding what it truly means to lead in this era of rapid transformation is crucial for success.

Embracing Empathy

One of the biggest shifts in leadership today is the emphasis on empathy. In the past, business leaders were often expected to maintain a “tough” exterior, focusing solely on profits and results. But now, leaders are expected to connect with their teams on a human level. Empathy allows leaders to understand their employees’ needs, concerns, and emotions. This makes it easier to create a positive workplace culture and build strong, loyal teams.

Empathetic leaders also know how to motivate people by recognizing their strengths and offering support when needed. This not only boosts morale but also drives productivity. Leaders who show compassion foster an environment of trust, where team members feel safe to share ideas, collaborate, and take risks. It’s a win-win for everyone.

Adaptability

In today’s fast-moving business landscape, adaptability is a non-negotiable trait for any leader. The world is constantly changing, whether it’s through new technologies, market shifts, or global events. To stay ahead of the curve, leaders must be able to pivot quickly and adapt to new circumstances.

Being adaptable also means being open to feedback and willing to make adjustments when things don’t go as planned. It’s all about keeping a flexible mindset and understanding that change is often necessary for growth. Modern leaders don’t shy away from uncertainty; instead, they embrace it and lead their teams through it.

Visionary Thinking: Leading With Purpose

A great leader today isn’t just someone who manages the day-to-day tasks. They’re a visionary who can see the bigger picture and chart a course for the future. Modern leaders inspire their teams by sharing a clear, compelling vision of where the company is headed. This sense of purpose not only keeps employees motivated but also helps them understand how their work fits into the larger mission.

Visionary leaders are also great at setting long-term goals and making strategic decisions that align with their company’s values. They understand that success isn’t just about immediate results—it’s about creating a sustainable future for the business and its people. By leading with purpose, these leaders can rally their teams around a shared mission and create a lasting impact.

Tech-Savviness

We live in a digital world, and today’s leaders need to be tech-savvy to navigate this ever-evolving landscape. From data analytics to artificial intelligence, technology is driving change in every industry. A modern leader must understand how to leverage these tools to improve efficiency, make data-driven decisions, and stay competitive.

But being tech-savvy doesn’t mean you need to be a coding expert. It’s about knowing which technologies are relevant to your business, understanding how they can improve processes, and being comfortable with innovations. Leaders who embrace technology and understand its potential will be better equipped to guide their businesses into the future.

Collaboration Over Command

Gone are the days of “top-down” leadership, where the boss’s word was final and employees were expected to simply follow orders. Modern leaders understand the power of collaboration. They actively involve their teams in decision-making processes, seeking input and encouraging diverse perspectives. By empowering employees to take ownership of their roles and contribute to the company’s direction, leaders create a more engaged and motivated workforce. This collaborative approach not only builds trust but also helps the company as a whole to be more innovative and responsive to challenges. Leaders who …

A political consultant helps politicians and other public figures navigate the complex world of politics. They can guide everything from messaging to fundraising to strategy. To become a political consultant, you need to have extensive knowledge of the political landscape and strong communication skills. CT Group is a firm that specializes in political consulting. They have a team of experienced professionals who can help you reach your goals in the political arena.

A political consultant helps politicians and other public figures navigate the complex world of politics. They can guide everything from messaging to fundraising to strategy. To become a political consultant, you need to have extensive knowledge of the political landscape and strong communication skills. CT Group is a firm that specializes in political consulting. They have a team of experienced professionals who can help you reach your goals in the political arena. There are several reasons why you should hire a political consultant. Here are some of the most important ones. First off, they can help you navigate the political landscape. A political consultant can help you understand the complicated world of politics and best navigate it. They will help you develop a strategy that fits your unique needs and goals.

There are several reasons why you should hire a political consultant. Here are some of the most important ones. First off, they can help you navigate the political landscape. A political consultant can help you understand the complicated world of politics and best navigate it. They will help you develop a strategy that fits your unique needs and goals.

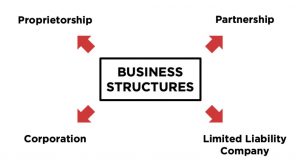

There is no limit to the number of members an LLC can have, and members may be individuals or other companies. An LLC has a maximum of two members, one for each business unit or a total of four members. There is no limit to the number of business units, the size of the company, and the number of members it can have. Depending on how the company is formed, how many employees and investors there will be, and to strike the right balance between capital and liabilities to support multiple classes of shares (which they can still support if needed), a small business or start-up can form an LLC.

There is no limit to the number of members an LLC can have, and members may be individuals or other companies. An LLC has a maximum of two members, one for each business unit or a total of four members. There is no limit to the number of business units, the size of the company, and the number of members it can have. Depending on how the company is formed, how many employees and investors there will be, and to strike the right balance between capital and liabilities to support multiple classes of shares (which they can still support if needed), a small business or start-up can form an LLC. An LLC limits your liabilities because it is legally separate from its owners. Your assets are protected from any action brought by employees, business partners, or the company itself for negligence. You can use the tax of the LLC – the tax exemption status and the ability to collect business debts without fear of losing the money you have invested in the company. The LLC is responsible for its debts and obligations, but its liability is limited by law because an LLC is “legally separate” from its owner.

An LLC limits your liabilities because it is legally separate from its owners. Your assets are protected from any action brought by employees, business partners, or the company itself for negligence. You can use the tax of the LLC – the tax exemption status and the ability to collect business debts without fear of losing the money you have invested in the company. The LLC is responsible for its debts and obligations, but its liability is limited by law because an LLC is “legally separate” from its owner.

advantage is that you are the sole owner of the company. You have total control over all decisions. You are not required to consult with anyone when making decisions or making changes. Lastly, the business is not taxed separately, so it is easy to comply with the tax reporting requirements. Also, the tax rates are lower than other business structures.

advantage is that you are the sole owner of the company. You have total control over all decisions. You are not required to consult with anyone when making decisions or making changes. Lastly, the business is not taxed separately, so it is easy to comply with the tax reporting requirements. Also, the tax rates are lower than other business structures. of this type of entity is that it protects the partners’ personal assets against the debts of the company or other obligations related to the business. You are allowed to pay taxes as a corporation or as an association. In LLCs, there are fewer registration documents and lower costs to start the business. Finally, there are fewer restrictions on profit sharing in limited liability companies since the partners distribute the profits as they see fit. Some of the disadvantages are that the creation process is more expensive than if a company is chosen.

of this type of entity is that it protects the partners’ personal assets against the debts of the company or other obligations related to the business. You are allowed to pay taxes as a corporation or as an association. In LLCs, there are fewer registration documents and lower costs to start the business. Finally, there are fewer restrictions on profit sharing in limited liability companies since the partners distribute the profits as they see fit. Some of the disadvantages are that the creation process is more expensive than if a company is chosen.

One of the significant factors you should consider when choosing a business entity is the taxation policy. There tend to be different taxation policies for business structures. You should ensure that you pick a business structure that has taxation policies that work in your favor.

One of the significant factors you should consider when choosing a business entity is the taxation policy. There tend to be different taxation policies for business structures. You should ensure that you pick a business structure that has taxation policies that work in your favor.